This is the second part of two blogposts about Bitcoin (short: BTC).

In the first blogpost we looked at what Bitcoin can do and why that makes it valueable.

1. Past BTC performance.

If you invested in Bitcoin at any point until until September 2017 you have done spectacularly, phenominally well.

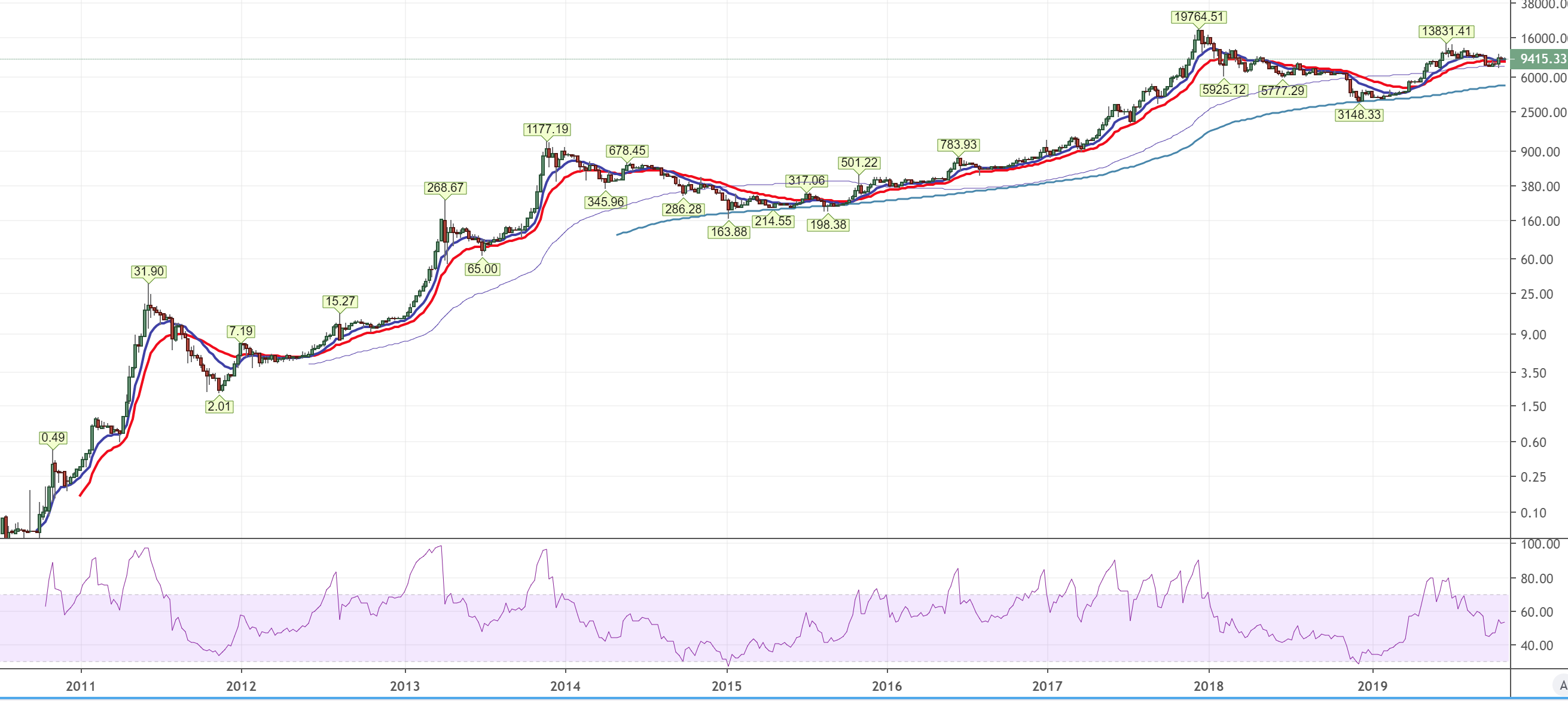

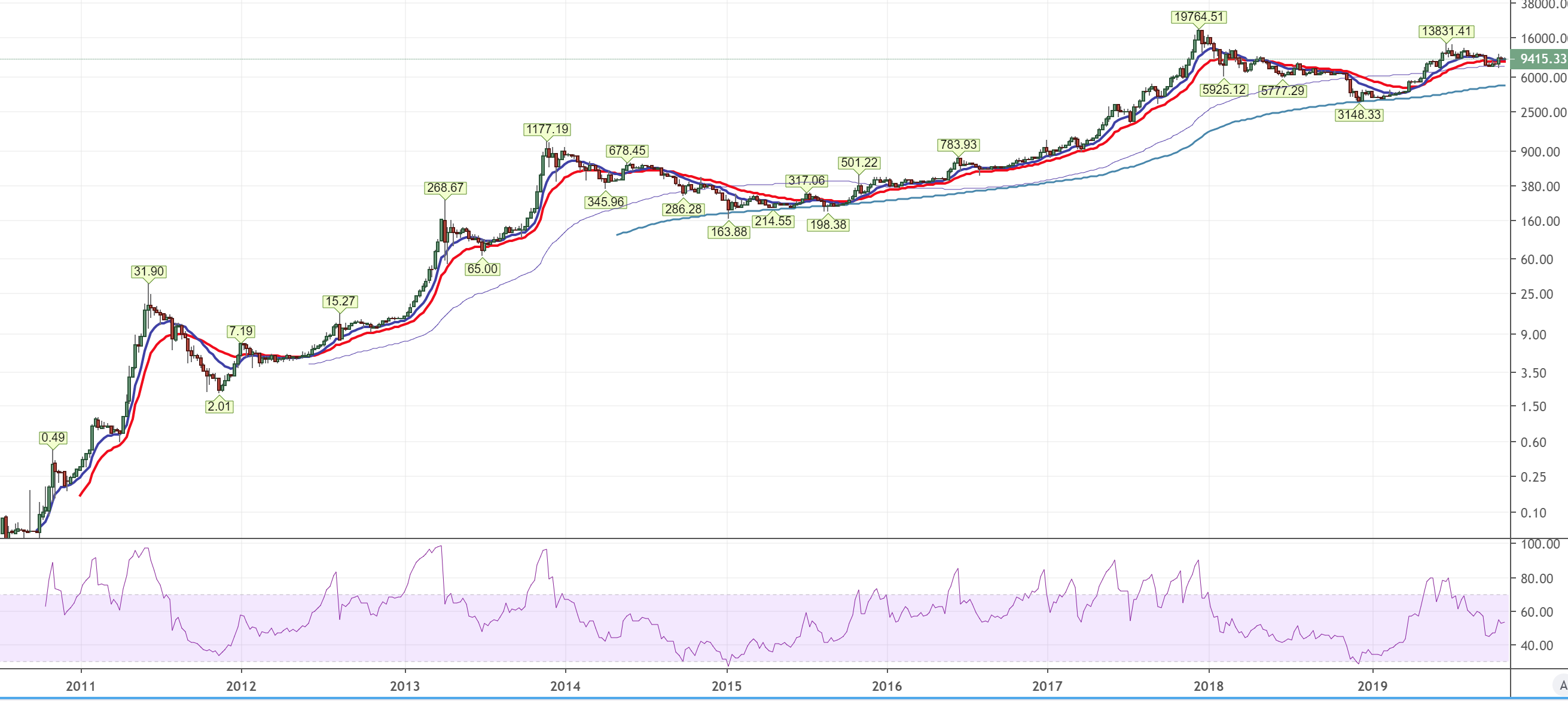

So spectacularly well you have to plot the chart on a logarithmic scale:

(BTC historical performance - Open image in new tab to maginfy)

You could have bought or sold one Bitcoin in January 2011 at around 0.3 USD,

in January 2012 at around 6 USD.

January 2013 at around 14 USD

January 2014 at around 450 USD

January 2015 at around 300 USD

January 2016 at around 600 USD

January 2017 at around 900 USD

January 2018 at around 15000 USD

January 2019 at around 3300 USD

and currently at around 7400 USD.

And with yearly candles:

(Bitcoin price chart. source: BLX)

Those are absolutely insanely high returns.

As you can see the Bitcoin price hasn't went straigt up. Actually the Bitcoin USD exchange rate regularly changes by 30% in a single month.

Source: https://cryptoslate.com/november-on-average-the-best-performing-month-for-bitcoin-january-poorest/

Those price differences are called volatility (the measure of how much the price changes in a given time). Volatility is undesireable to an investor, because it can cause drawdowns (decline in % if you invested at a local high). However also the price going up is volatility. Ideally an investment would just monotonically go up in price, having just "good" volatility from price increases - but that does not exist, an open market price always oscillates. ;-).

Even if accounting for the fact that the Bitcoin price is very volatile with the so called sharpe ratio, which punishes volatile assets, Bitcoin is still by far the best performing asset between stocks, bonds, gold, oil http://charts.woobull.com/bitcoin-risk-adjusted-return/ when held for a 4 year period at any point over its 10 year existance.

No wonder retail investors with no idea what makes Bitcoin valueable (read my first Blogpost), fell for scaming schemes the last years. Scam copy-cats like "Onecoin" and "Bitconnect", which were pozi scemes without any actual crypto-blockchain behind it. If the real thing is giving you 1000% returns in a year why wouldn't the "Bitconnect" scam?

But past performance alone is not indicative of future results. For all we know, Bitcoin could be hugely overpriced and overbought after it's astronomical price rise the last ten years. We have to dig deeper!

2. My story

I can't remember exactly when I first heard about Bitcoin. But I participated in the Bitcoin network by providing a server with my computing power to it. And I mined 1 Bitcoin (BTC) on my home computer in 2013 on an AMD graphics card.

Back then it was still possible to just earn a Bitcoin economically on your computer. Nowadays almost all Bitcoin servers use highly efficient specialized mining computers to be able to provide the most computing power to the network for a low power bill, and therefore get more "mining reward" to help people transact securely.

But I never bought any Bitcoin with my EUR savings! I seriously considered it when Bitcoin price fell below USD 500 in 2015 after peaking at USD 1000 and I thought it was cheap. I never did, because I was too cautious!

Specifically I was worrying about:

- (a) What if a better crypto coin overtakes BTC just as Facebook overtook Myspace/Studivz?

- (b) What if BTC is outlawed or trade with BTC forbidden?

- (c) What if the exchanges go under and trust in BTC is permanently shattered?

So I never bought more Bitcoin while some friends earned hundres of thousands of EUR being invested into BTC. But that's ok, hindsight is always 20:20 and it could have gone the the other way.

I kind of payed low attention to Bitcoin the following years, being busy with life and startup. I briefly thought about Bitcoin when the price peaked at about USD 20k in December 2017 making headlines. I remember at the time talking with my friend Erik Bovee on Facebook about selling some (because during the mania with the price peak, the game company Valve stopped accepting it as a payment for their game store Steam because the bitcoin network of servers was so slow confirming transactions and the BTC price so volatile, making it completely unacceptable as a currency). But I didn't really have much to sell anyway.

The next time I really thought about Bitcoin was a year ago in December 2018 when I took an Uber taxi and the Uber driver asked me something to the effect of "Bitcoin is going horrible, no chance it recovers, am I right?". That caught my attention because if your taxi driver and hair dresser and dentist (you get the idea) are buying stuff you should likely sell it. If your taxi driver is telling you X will never recover it might be a good time to buy. I confirmed that Bitcoin had just heinously dropped in price from 6000 to around 3000 USD with fears of further drops. Bitcoin had become 83% cheaper than a year ago. In hindsight this was a so called "capitulation" move were many owners of Bitcoin where so frustrated by the drawdown they gave up on it and sold at ridiculous cheap prices.

So that further peaked my interest about buying. So I researched a lot if it was in fact cheap, or if there were still fundamental open issues about Bitcoin - the result is basically most of what is in the blogpost further below for you!

And as you will see all fears (a),(b),(c) that I had with Bitcoin in 2015 had been more than addressed. In January 2019 I was conviced. I even started harrassing my close friends and family about buying bitcoin.

Rarely anybody listened - except my girlfriend. Also my friend Markus R. who had already some exposure, and some others who I am not sure if they are comfortable being named increased their investments. And my parents are are amazing as well.

3. Issues addressed

3.A What if a better crypto coin overtakes BTC just as Facebook overtook Myspace/Studivz?

Is Bitcoin the right horse to bet on, or will I end up with "worthless internet money" when the next better coin eventually comes along?

Like the Google Chrome Browser Bitcoin is based on open source technology.

Everybody can take the code from "Google Chrome" web browser (with some exceptions like Google's secret encrypted video playback technology), call it something different like "Franz" browser and try to covince people to use theirs instead of Google's web brower.

Except it's not that easy. Let's build on what I wrote about what bitcoin is in the first blogpost.

Bitcoin comprises of

- the network of 10000+ servers of expensive computers that process, vote on and protect the transactions, and consuming loads of expensive electricity to do so ( it is purposely designed to take effort to run them)

- the transaction log that all those servers store showing who transacted what and how much bitcoin is owned by which wallet's addresses

and the whole ecosystem around the coin such as

- exchanges that match up buyers and sellers for bitcoin for fiat currencies

- Bitcoin ATMs (cash machines)

- Bitcoin wallet software used to interact with your wallet

- other projects using the bitcoin servers to build other services on top

- all the people owning bitcoin already

- people that know about bitcoin or are trained in using bitcoin or programming with it

If you were to copy Google Chrome browser you would have to convince internet users to use your "Franz" browser instead of Googles instead, which is difficult but not impossible.

But with Bitcoin it's a lot harder. Not only would you have to convince the users, you would also have to convince the existing 10.000+ server operators to switch or get new operators to use your Bitcoin copycat instead. You would have to create new wallets, convince exchanges and ATM operators and all the people who bought and spent money for Bitcoin to use your coin instead. Not gonna happen. Because of network effect.

See this video: https://youtu.be/p0ftZgCEZos?t=71 in full.

Even if you were to invent a slightly better Bitcoin, the space of what Bitcoin does is already taken. Imagine you have a slighly better rabbit in an ecosystem. If your better rabbit came much later than the original rabbit species, even if it's better it will compete with a gazillion other already established rabbits for food. Your new better rabbit will fail spectacularly.

Still people have tried to build a better Bitcoin. And they have done so in various ways.

Keeping the transaction log (i.e. the "wallet balances")

In 2017 and 2018 some people created a new kind of Bitcoin called "Bitcoin Cash" and "Bitcoin SV". They both claimed to be the real Bitcoin. They made minimal changes to the code and they kept the transaction log of who owns what.

Those kinds of copy cats are harmless to a long-term Bitcoin investor. Because the same Bitcoin transaction log is used in the copy cat, you know have both the real Bitcoin and Bitcoin Cash copycat wallet balances. Congratulations!

Still having multiple Bitcoins could have been confusing. And the transaction logs would have diverged over time. But it's good to know that by now it's all but certain that the Bitcoin Cash and Bitcoin SV initiatives (also called "forks") have failed to convince any meaningful number of server operators to join their crypto network instead of Bitcoin. Bitcoin is the firm leader and the failure of Bitcoin Cash and Co. will be a deterent to future forks.

New Coins not keeping the transaction log

As I said people have tried to build a better Bitcoin, but not keeping the balances and not calling it Bitcoin.

Those can be differentiated into classes like

The Distributed Apps (D-Apps, "Smart Contract") coins

It turns out that the technology that Bitcoin is based on isn't just great as a store of value commodity, but it can also be used to create immutable clould programms. So basically you can use the network of servers to not just send coin transactions but also to do general computation tasks. You pay for the compute usage with the coin. Bitcoin itself doesn't support this D-Apps use-case well.

By far the most prominent of those crypto coins is Etherium (ETH).

There are others with their own spin (easier to programm, more efficient) such as

EOS, NEM, NEO, Cardano. But they suffer from the same fate as coins that want to compete with Bitcoin. Etherium has already established itself, so the new coins while maybe better have a hard time competing.

New money coins and money services

Those are coins that want to be like Bitcoin but better suited for direct use as a day to day cash currency. They have various differences compared to Bitcoin like faster transaction processing and/or better anonymity about transactions. Examples are Litecoin, Zcash, Monero, and DASH and (to some degree) Lightning Network.

Stable coins

Stable coins do not have a limited number of coins that will be created like Bitcoin. Instead they are I-Owe-You tokens for some stable asset. Read: not the e.g. +/- 10% volatility in a day of e.g. Bitcoin.

Two examples are Tether and Libra coin.

Tether is emmited by a company that sells you a Tether for an USD each. And then promises to keep that USD on their account and it will exchange that Tether back to one USD. They print Tether when people are buying them with USD and destroying them as people return them for USD. The problem is that you have to trust this company to actually keep that USD safe and uphold it's promise to exchange it back. On the positive side you now have a crypto coin that is not volatile but approximately tied to the value of a dollar 1:1.

Facebook's US/Swiss Libra coin wants to be very similar in the future. They want to buy treasury notes and currency of different currencies (currency basket) with the fiat money people spend on their coin to create an international stable coin.

Other Tokens for service or ownership coins

Loads of companies have used the popularity of crypto to create more coins. Those coins, like stable coins are tokens redeemable for something (but not currency like with stable coin). Mostly for services. One company would maybe create their own currency to only offer their products in this currency. Then people who wanted their product couldn't just buy it with USD or EUR directly they first had to exchange into this fantasy token. Example 0: One token/coin could represent the right to use 1 Gigabyte of online storage for a month. You could then buy this token on an exchange for a fair market price. When you actually provided cloud space you could gain those tokens. Expample 1: One company would pay you tokens to view adds while surfinging the web, while advertisers can buy those coins to show you the adds. Example 2: Exchanges would sell you their own crypto token, that you could use to pay for trading fees. Effectively getting money up front, and offering you discounts if you payed the trading fees with those tokens.

Other tokens/coins would represent shares in companies or some other claim on future payouts ("initial coin offering - "ICO").

This category of ownership and product coins and tokens was by far the most scumy and unnecessary category of coins. Naive retail investors would spend millions on crypto coins, many of which turned out to be worth nothing.

Don't get me wrong, it does have an advantage that you can trade your reward tokens (e.g. BAT) on an exchange (https://youtu.be/rPq2zxTSWuc?t=517). But is it strictly necessary? No?

What do all of those coins have in common?

All of those coins are called Altcoins.

They had a hard time getting adoption and convincing anybody to create servers for them. Today the most healthy server network besides Bitcoins is Etherium.

Other coins that have a network that is n OK to secure are e.g. Litecoin, Monero and Zcash.

Most newer coins try to use technology that tries to reduce the advantage you can get from specialzied computers. Their computer networks run well on commodity computers. Therefore they hope that they can get a secure transaction server network even if it's smaller than Bitcoins, because when it runs best on commodity computers smaller less, concentrated, and therefore less easily attacked networks can still be competitive.

If they don't use their own network then they are piggibacking off the bigger networks by storing extra data for their coins into Bitcoin's or Etherium's blockchain (Most small tokens for service or ownership coins, Tether).

Others have created a model where the networks do not vote with their computing power but with a proof of owernership of coins. The thought is that when you can proof that you own a coin you have less incentive to make bad transactions because it would hurt the network and therefore undermine the value of the coins that you already own. This technology is still very immature but small coins are migrating towards it because of despreation. Because their coins are not popular they can not adequately pay their server operators in mining fee for their electricity, so instead they have to adapt this ownership model. Few wealthy people could still potentially attack the system, when the price of the coin is too low, but it is not reasearched enough yet. Cardano is an example. Etherium (which is the strongest network besides Bitcoin) is also moving slowly into direction of Proof of Stake/Ownership.

Other coins have given up on the core strength on Bitcoin, the resilient distributed nature all together, and instead of running thousands of decentralized servers they only have a few dozzens. Examples are: XRP, Libra, Binance Coin. They try to make up for the fact by securing access to that few remaining servers very heavily. But they are completely incomparable to Bitcoin security wise. Those tokens tend to do better in countries where the population is more brand loyal and doesn't have as much cultural value on decentralization and censorship resistance (Asia https://www.youtube.com/watch?v=qsEnqUvESL0)

A lot of coins would trade only a tiny fraction of the total supply of coins on an exchange. The rest would be reserved for a few select, or sold by a company to fund the development and promotion of the coin. The small traded fraction, driven up in price by naive retail investors would lead to an inflated market cap of the coin.

Some other systems do not even attempt to be a coin, but a just services built on top of bitcoin ("2nd layer solutions")

For example credit cards that would work like regular creadit cards and take the value of your purchases off your bitcoin balance once a month.

Or other services that facilitate fast purchases and then settle the balance in BTC later (such as "Lightning Network").

In summary

In summary no crypto coin has ever come or will likely ever come close to replacing Bitcoin as an electronic commodity with excellent properties to store wealth.

There are coins that have other use-cases like Etherium, Monero or Lightning Network, that are different enough to be worthy porjects on their own.

Altcoins are not bad per se, but they still have a lot of proofing to do if they provide value in their specific niche, enough to justify their network requirements.

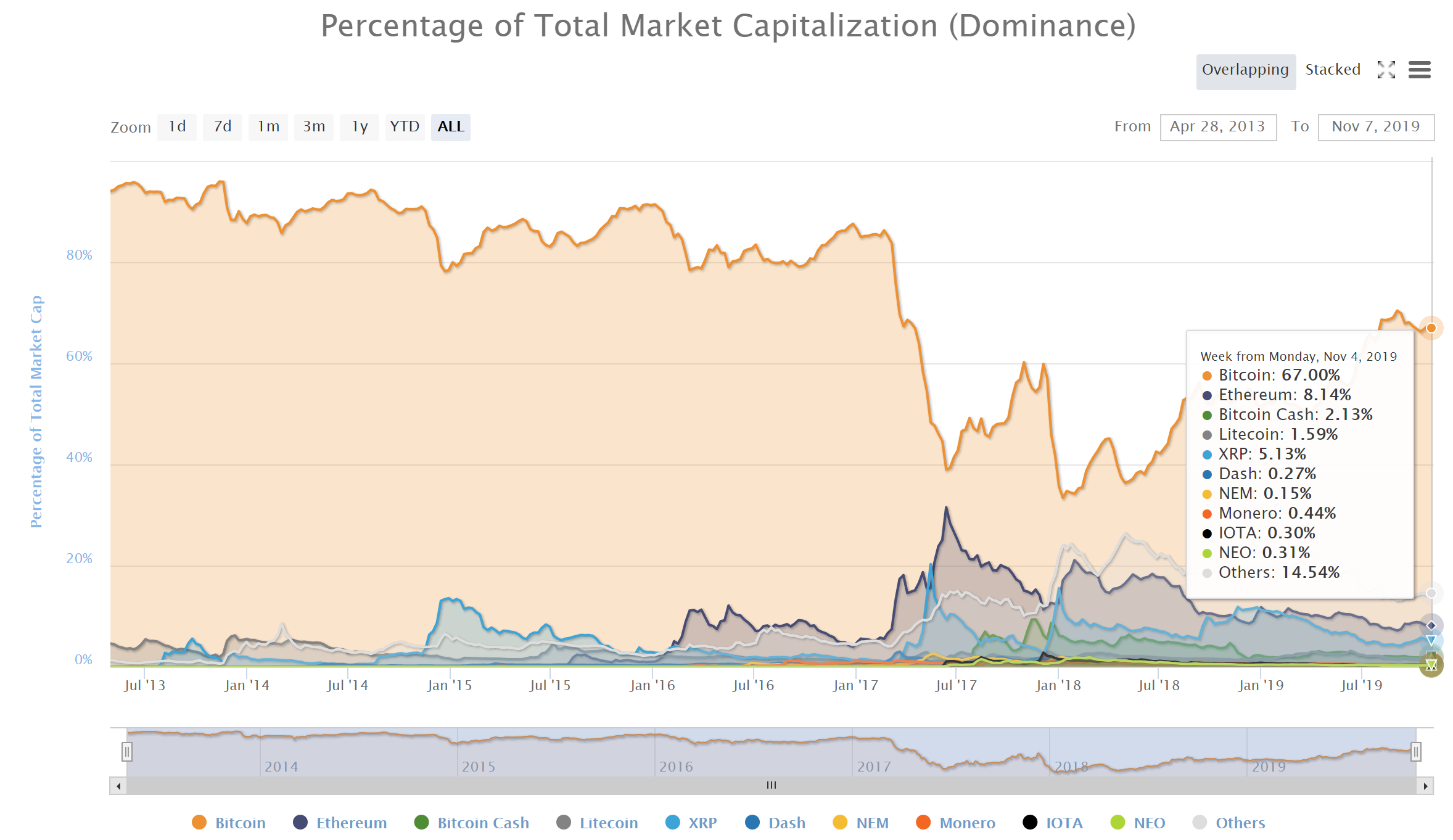

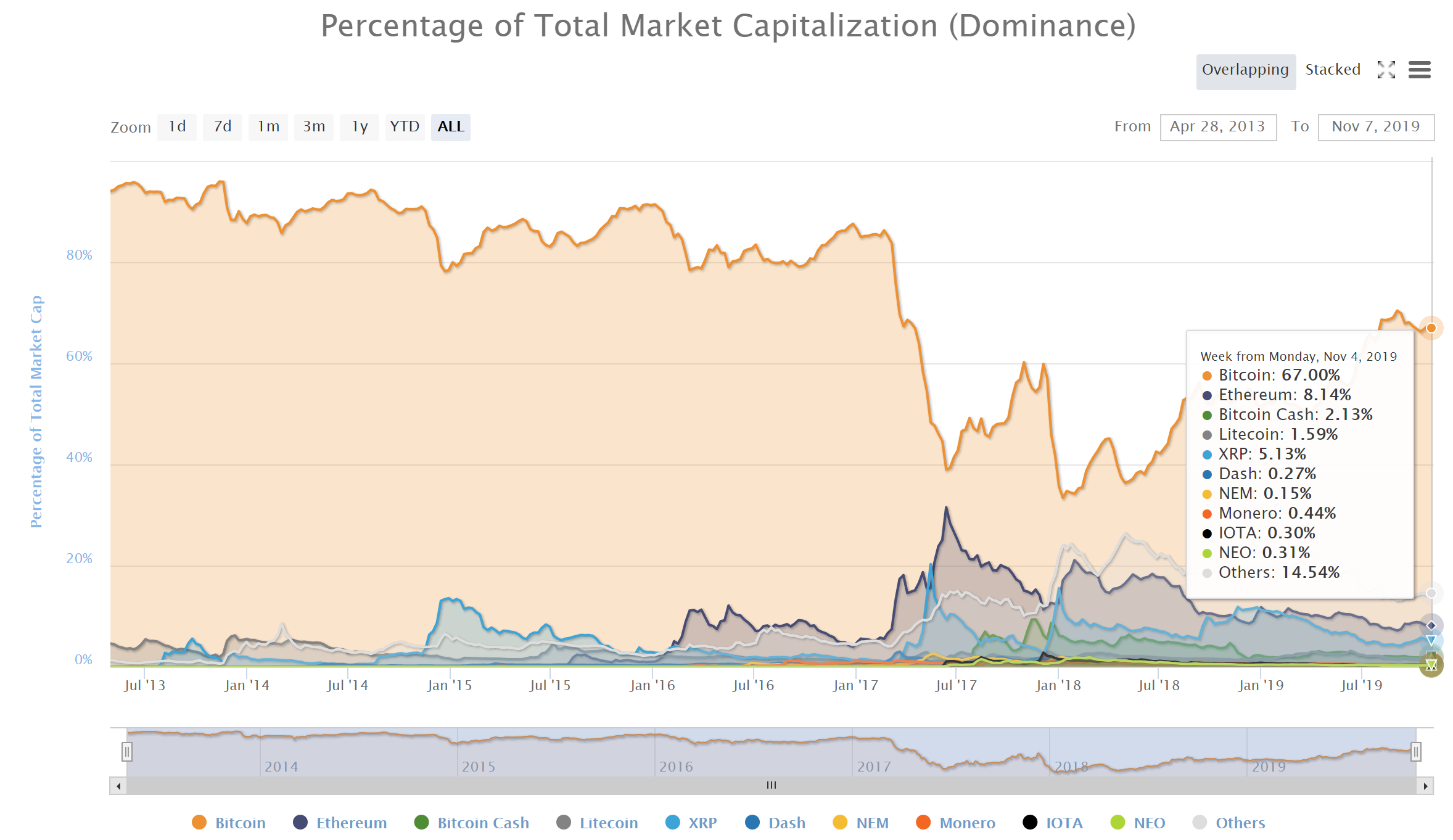

Today 2/3s of all investment money into crypto (excluding stable coins) have gone into Bitcoin. Number two is Etherium with just 8.1%.

3.B What if BTC is outlawed or trade with BTC forbidden?

My greatest fear has always been that a government says it's now illegal to exchange Bitcoin for fiat money.

[... to be amended....]

3.C What if the exchanges go under and trust in BTC is permanently shattered?

[... to be amended....]

4. Other fundamental developments

[... to be amended....]

5. Summary

[... to be amended....]

Followup

Read in part 3/4(/5?) what

- I stipulate about bitcoins price development in the future

- how I would invest

- and what other potential risks there may arrise in the future that I have ommited for breivity but want to document in an appendix of some sort.

You must be logged in to post a comment.